This website uses cookies. By using this website, you agree to our Cookie Policy.

Michael Liu, Jane Ng, Viola Jing and Keith Gerver have authored a Clients & Friends Memo to discuss the latest trends in reviews conducted by the Committee on Foreign Investment in the United States (CFIUS) for Chinese investors contemplating possible investments in U.S. assets. The Memo provides a recap of the CFIUS framework and process, and some recommendations to avoid unnecessary complications and after-deal scrutiny from CFIUS.

Introduction

On February 26, 2015, the Committee on Foreign Investment in the United States (“CFIUS”) - the interagency body charged with reviewing the impact on U.S. national security of any merger, acquisition or takeover that could result in the control of a U.S. business by a foreign person (including corporations) - issued its 2015 annual report to Congress. The report, which covers 2013, confirms the trend that CFIUS is focusing more attention on investment into the United States from the People’s Republic of China (“PRC” or “China”). As China continues to be one of the most active investors in the United States and CFIUS continues to closely scrutinize transactions involving Chinese acquirers, this Clients & Friends Memo summarizes the latest CFIUS trends for Chinese investors contemplating possible investments in U.S. assets, and provides a recap of the CFIUS framework and process.

Foreign Direct Investment in the United States

Foreign Direct Investment in the United States continues to grow at a strong pace: foreign firms invested $236 billion in the United States in 2013, representing a 35% increase over 2012. Indeed, the United States ranked as the world’s top destination for foreign investment for the second year in a row, according to the 2014 A.T. Kearney Foreign Direct Investment Confidence Index.1 The vast majority of foreign direct investment in the United States comes from the world’s most advanced economies: Japan, the United Kingdom, Luxembourg, Canada, and Switzerland represented the top five foreign direct investors in 2013.2 China - the 14th largest foreign direct investor in the United States in 2013 - actually decreased its investment in the United States for the first time since 2009 to about $2.5 billion. This was about a 30% drop from 2012.3 Increased scrutiny from CFIUS likely accounted for some of the decline in Chinese foreign investment.4

CFIUS Process

Under section 721 of the Defense Production Act of 1950, as amended by the Foreign Investment and National Security Act of 2007 (“FINSA”), 50 U.S.C. App. § 2170, CFIUS is charged with reviewing “covered transactions” - mergers, acquisitions or takeovers by or with any foreign person that could result in foreign control of any person engaged in interstate commerce in the United States - to determine the effects of such transactions on the national security of the United States, taking into consideration 11 statutory factors.5 A CFIUS review of a covered transaction can either be initiated by CFIUS itself - even after a deal has closed - or through a voluntary written notice jointly filed by the parties to the transaction.6 Indeed, CFIUS is not obligated to review all foreign direct investment that may be a “covered transaction” as defined by FINSA, nor are parties to such transactions required to file a written notification of the deal with CFIUS.

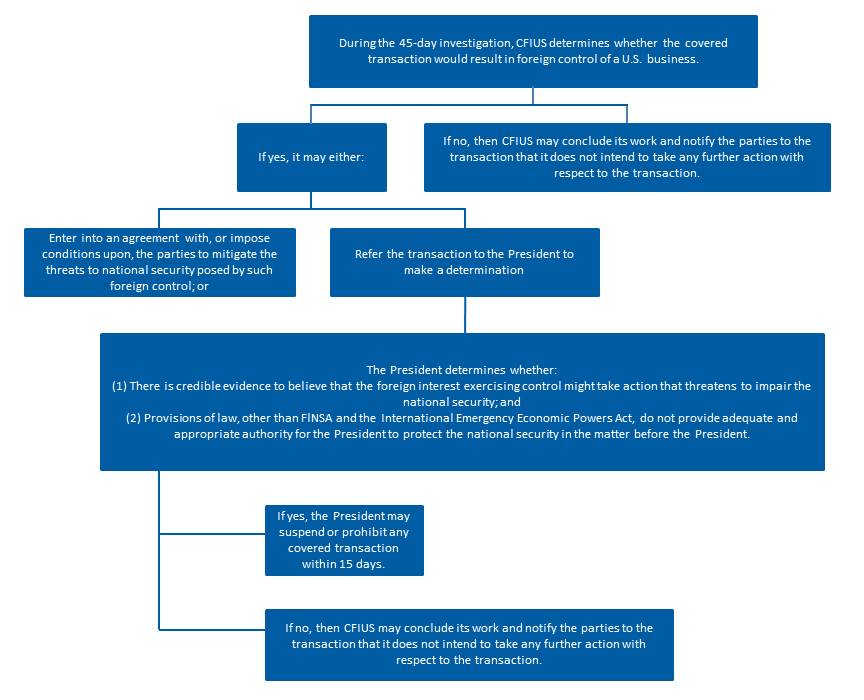

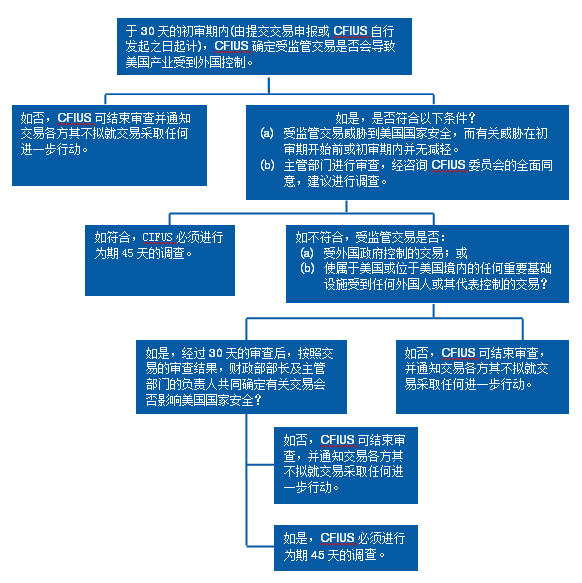

The review and investigation processes of CFIUS are outlined below.

The Review Process

The Investigation Process

Key CFIUS Concepts

“Control”—Transactions solely for the purpose of passive investment with a foreign person holding ten percent or less of the outstanding voting interest in a U.S. business are not “covered transactions”.

Understanding certain key concepts is crucial to successfully navigating CFIUS. First, as outlined clearly above, the concept of “control” lies at the heart of any CFIUS review. FINSA does not define the term, but instead directs CFIUS to provide a definition via regulation.7 As CFIUS stated in its commentary on its regulation, control is defined “in functional terms as the ability to exercise certain powers over important matters affecting an entity.”8 Specifically, control means:

The power, direct or indirect, whether or not exercised, through the ownership of a majority or a dominant minority of the total outstanding voting interest in an entity, board representation, proxy voting, a special share, contractual arrangements, formal or informal arrangements to act in concert, or other means, to determine, direct, or decide important matters affecting an entity; in particular, but without limitation, to determine, direct, take, reach, or cause decisions regarding the [matters listed in 31 C.F.R. § 800.204(a)], or any other similarly important matters affecting an entity.9

Whilst there is no hard and fast rule regarding what percentage of an ownership stake might constitute control given the functional definition above, the Regulations make clear that a “transaction that results in a foreign person holding ten percent or less of the outstanding voting interest in a U.S. business (regardless of the dollar value of the interest)” is not a “covered transaction,” as long as the transaction is “solely for the purpose of passive investment.”10 The Regulations further state that:

[O]wnership interests are held or acquired solely for the purpose of passive investment if the person holding or acquiring such interests does not plan or intend to exercise control, does not possess or develop any purpose other than passive investment, and does not take any action inconsistent with holding or acquiring such interests solely for the purpose of passive investment.11

“National Security” — An Amorphous Concept

Second, the term “national security” is a notoriously amorphous concept. FINSA does not offer a definition, other than to note that the term includes “those issues relating to ‘homeland security’ including its application to critical infrastructure.”12 Given the inherent breadth of the concept, many transactions that might not at first seem to involve national security issues could come within CFIUS’s purview, as demonstrated most recently by the 2013 acquisition of food processor Smithfield Food Inc. by China’s Shuanghui International Holdings Ltd. Due to the potential impact on “food security,” which some commentators argued should be seen as an aspect of national security, the parties filed a voluntary notice with CFIUS; CFIUS ultimately did not oppose the transaction.

“Critical Infrastructure” — Defined to Include Nearly all Aspects of the U.S. Economy

Third, the term “critical infrastructure” is itself vague, defined to mean “systems and assets, whether physical or virtual, so vital to the United States that the incapacity or destruction of such systems or assets would have a debilitating impact on national security.”13 Indeed, nearly all aspects of the U.S. economy could fall within one of the 16 critical infrastructure sectors identified by Presidential Policy Directive/PPD 21, 'Critical Infrastructure and Resilience'. As such, many more deals are likely to come under CFIUS review.

2015 Annual Report Findings and Potential Trends

Number of Notices Filed

According to the 2015 annual report recently released by CFIUS , during 2013, 97 notices of transactions were filed with CFIUS which CFIUS determined were “covered transactions,” down from the five-year high of 114 set in 2012. Of the 97 notices filed, 48 resulted in 45-day investigations, a slight increase from the 45 investigations conducted in 2012. But as a percentage of filed notices - 49% - the number of investigations represent a marked increase over previous years (39% in 2012, 36% in 2011, 38% in 2010, and 38% in 2009). The 2015 annual report partly attributes the percentage rise to five cases proceeding to the investigation stage because of the October 2013 government shutdown, which prevented CFIUS from completing the initial review of those cases within the statutory 30-day period. Even not taking into account those five cases, however, the percentage of notices that proceeded to investigation would have risen to 44% in 2013.

Withdrawal of Notices

On the other hand, of the 48 notices that proceeded to an investigation, only five were withdrawn after the investigation had commenced, a steep drop from 2012, where 20 notices were withdrawn after an investigation had begun. In total, eight notices were withdrawn in 2013; the parties in only one of those eight cases re-filed a new notice in 2014. As reported in the 2015 annual report, parties requested withdrawals for a number of reasons, for example, where (a) the parties were unable to address all of the CFIUS' outstanding national security concerns within the initial 30-day review period or 45-day investigation period; (b) there was a material change in the terms of the transaction; (c) the parties abandoned the transaction for commercial reasons; (d) the parties did not want to abide by CFIUS' proposed mitigation; or (e) CFIUS recommended that the President suspend or prohibit the transaction. The decline in withdrawn notices indicates either that CFIUS was satisfied that the covered transactions in question did not impair U.S. national security, or, more likely, CFIUS and the parties to the transactions were able to reach agreement regarding mitigation.

China Ranks First

In 2013, for the second year in a row, Chinese investment in the United States accounted for the largest number of covered transactions reviewed by CFIUS. China also surpassed the United Kingdom in the total number of covered transactions reviewed by CFIUS for the period between 2011-2013.

Insights for the Way Forward

The 2015 annual report provides additional insight into what mitigation measures CFIUS might request parties to a covered transaction to adopt to assuage CFIUS concerns over foreign control. While the list of example mitigation measures remained mostly unchanged from the 2013 annual report, there was a notable addition that indicates a potentially more aggressive stance by CFIUS with respect to mitigation measures. Specifically, CFIUS required parties to at least one of the 11 covered transactions in which mitigation measures were applied in 2014 to provide the U.S. government “with the right to review certain business decisions and object if they raise national security concerns.” In other words, this mitigation measure would allow the U.S. government to take part in the management of the business.

New findings contained in the “Critical Technologies” section of the 2015 annual report also suggest a more aggressive approach by CFIUS in the future, especially with respect to covered transactions involving businesses in countries whose governments are believed to engage in economic espionage. In a departure from the conclusion in the 2013 annual report, the U.S. Intelligence Community (“USIC”) now “believes there may be an effort among foreign governments or companies” to acquire U.S. companies involved in research, development or production of certain critical technologies. “Critical technologies” generally include defense goods and services controlled on the U.S. Munitions List, certain export-controlled military, chemical and biological weapons, missile and nuclear technologies, and select agents and toxins. The 2015 annual report further notes that the USIC “judges that foreign governments are extremely likely to continue to use a range of collection methods to obtain critical U.S. technologies.” As such, CFIUS is likely to scrutinize covered transactions involving critical technology in more depth going forward.

Conclusion

While CFIUS contends that it reviews transactions on a “case-by-case” basis, the 2015 annual report further supports the notion that it has been paying particularly close attention to deals that could result in Chinese investors controlling U.S. businesses. To avoid unnecessary complications and after-deal scrutiny from CFIUS, Chinese investors should strongly consider voluntarily filing with CFIUS if they are involved in a merger, acquisition or takeover that involves national security - defined broadly - that would result in foreign control - again, considered broadly - of a U.S. business. Indeed, CFIUS staff are known to scour the financial press, and if they find a deal that could be considered a covered transaction that might affect national security, they will likely contact the parties to request a filing or even unilaterally open a review. To ensure smooth dealings with CFIUS, the parties should propose methods of mitigation early in the review process to ensure that certain identified issues are dealt with.

1 A.T. Kearney, The 2014 A.T. Kearny Foreign Direct Investment Confidence Index: Ready for Takeoff 1 (2014), available at www.atkearney.com/documents/10192/4572735/Ready+for+Takeoff+-+FDICI+2014.pdf/e921968a-5bfe-4860-ac51-10ec5c396e95.

2 Organization for International Investment, Foreign Direct Investment in the United States – 2014 Report 5 (2014), available at www.ofii.org/sites/default/files/FDIUS2014.pdf.

4 David Dollar, Why So Little Investment between the United States and China?, Up Front (Feb. 26, 2015, 1:42 PM), http://www.brookings.edu/blogs/up-front/posts/2015/02/26-investment-between-us-and-china-dollar.

5 50 U.S.C. App. §§ 2170(a)(3), (b)(A)(i), (f)(1)-(11). The 11 factors, codified at 50 U.S.C. App. § 2170(f), generally fall into three categories: the nature of the foreign investor, the vulnerability of the target, and impact of the deal on both U.S. national security and global security.

8 Regulations Pertaining to Mergers, Acquisition, and Takeovers by Foreign Persons, 73 Fed. Reg. 70,704 (Nov. 21, 2008) (to be codified at 31 C.F.R. § 800).

在美国进行投资:中国投资者对CFIUS的疑虑

2015年7月9日

刘瑞隆、吴敏珊、郑翠苗及Keith Gerver共同撰写了一份客户备忘录,以探讨美国外国投资委员会(CFIUS)对拟投资于美国资产的中国投资者进行审查的最新情况。本备忘录重申CFIUS的架构和审查流程,并就如何避免把问题复杂化及CFIUS在交易完成后进行监察,提供一些建议。

引言

美国外国投资委员会(“CFIUS”) 是一个跨部门组织,如有任何并购或收购交易可能导致美国产业受外国人士(包括公司)控制,这个组织有权审查有关交易对美国国家安全的影响。2015年2月26日,CFIUS向国会提交2015年度报告。该报告涵盖2013年度,确认CFIUS提升了对中华人民共和国(“中国”)在美投资的关注程度。由于中国仍然是美国最活跃的投资者之一,而CFIUS一直紧密监察涉及中国收购方的交易,因此本客户备忘录概括了一些有关CFIUS对拟投资于美国资产的中国投资者进行审查的最新情况,以及重申CFIUS的架构和审查流程。

在美国的外商直接投资

在美国的外商直接投资继续保持强劲增长:2013年外国公司在美国投资了2,360亿美元,较2012年增加35% 。事实上,根据《2014年科尔尼外商直接投资信心指数》1,美国连续两年成为全球排名首位的外商投资目的地。在美国的外商直接投资绝大部分来自全球最先进的经济体系:日本、英国、卢森堡、加拿大及瑞士名列2013年度的五大外商直接投资者。2 同年,中国在美国的外商直接投资排名第14位,而实际上该年度对美国的投资是自2009年以来的首次减少,投资额调低至约25亿美元,较2012年下降了约30%。3 CFIUS增加审查可能正是部分中资在美国减少投资的原因。4

CFIUS 的审查流程

根据《1950年国防生产法案》第721条(经《2007年外商投资及国家安全法案》(“FINSA”)(50 U.S.C. App. § 2170)作修订),CFIUS负责透过考虑11项法定因素,审查

“受监管交易” (即由任何外国人进行或与任何外国人一起进行的并购或收购交易,而该等交易将可能会导致任何在美国从事跨州贸易的人士受到外国控制),以确定该等交易对美国国家安全的影响。5 CFIUS对受监管交易的审查可以是由CFIUS自行发起(即使是在交易完成后),或通过交易各方共同提交自愿性书面申报的方式进行。6 事实上,CFIUS不必审查所有根据FINSA的界定可能构成“受监管交易”的外商直接投资,而该等交易的各方也无需向CFIUS提交有关交易的书面申报。

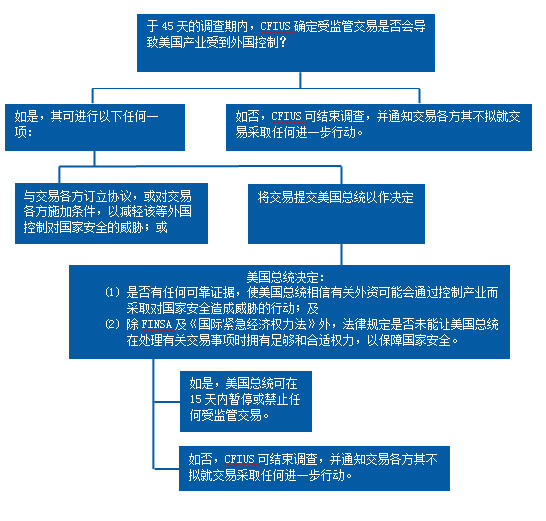

CFIUS的审查及调查流程概述如下:

审查流程

调查流程

CFIUS的某些主要概念

"控制" – 仅为进行被动投资(即外国人士持有美国产业的已发行投票权10%或以下)而订立的交易不属于“受监管交易”。

理解某些主要概念,对驾驭CFIUS是非常重要的。首先,上述已清楚概述,“控制”这个概念是CFIUS任何审查工作的核心元素。FINSA并无对这词作出界定,只赋予CFIUS权力通过法规对该词进行定义。7 按照CFIUS对其法规的解释,“控制”被界定为“就功用性定义而言,指可影响实体的重要事宜而行使某些权力的能力。” 8 特别是,“控制”指:

通过拥有一实体的多数或占主导地位的少数的合计已发行投票权、董事会代表、代理投票、特殊股份、合同安排、一致性行动的正式或非正式安排,或其他途径获得的直接或间接权力(不论是否行使该等权力),以确定、指示或决定可影响实体的重要事宜,特别是(但不限于)确定、指示、作出、达致或促使对有关[31 C.F.R. § 800.204(a)所列事项]或可影响该实体的任何其他类似重要事宜的决定。9

虽然按照以上的功用性定义,CIFUS没有严格规定构成控制是指拥有多少百分比的股份,但其法规已清楚订明,只要交易“仅是为了进行被动投资”,则“使外国人持有美国产业的已发行投票权10%或以下的交易(不论权益的金钱价值)” 并不属于“受监管交易”。10 其法规进一步订明:

下列情况属于仅为进行被动投资而持有或取得权益:如持有或收购该等权益的人士并无计划或不拟行使控制权、除被动投资外不具有或不发展任何其他用途,并且没有采取任何与为进行被动投资而持有或收购该等权益不一致的行动。11

"国家安全" – 模糊概念

其次,“国家安全”这个词语是一个非常模糊不清的概念。 除说明这个词语包括 “与‘国土安全’有关的事宜,包括对重要基础设施的适用情况。”外,FINSA没有给予任何定义。12 由于这个概念本身可以广泛应用,很多交易原先看似不涉及国家安全问题,也被CFIUS纳入审查范围之内。最近期的例子有中国的双汇国际控股有限公司于2013年收购食品加工商 Smithfield Food Inc.。由于可能会影响到“食品安全”,令若干评论者认为应视作国家安全范围,因此交易各方向CFIUS提交自愿性申报,但CFIUS最终没有反对该项交易。

"重要基础设施" 的定义包括近乎所有的美国经济事宜

第三,“重要基础设施” 这个词语本身意义含糊,它被界定为“任何对美国非常重要的系统和资产(不论是实体或虚拟的),如该等系统和资产在丧失功能或遭受破坏的情况下将会造成大幅削弱国家安全的影响。”13 实际上,近乎所有的美国经济事宜都属于《总统政策指令/PPD21,关键基础设施与适应力》所识别的16个重要基础设施领域。因此,将会有更多交易需要经过CFIUS的审查。

2015年度报告结果及趋势展望

向CFIUS提交的交易申报

根据CFIUS最近刊发的2015年度报告,于2013历年内,共有97项交易申报被 CFIUS 确定为“受监管交易”,较2012年属于5年新高的114项有所下降。 在该97项交易申报中,48项经历了45天的调查,较2012年进行的45项调查略为上升。但按照提交申报的比例49%来看,调查数量较过去数年大幅上升(相对于2012的39%、2011年的36%、2010年的38%,以及2009年的38%)。根据2015年度报告所述,部分比例增长是由于2013年10月美国政府关闭,令CFIUS无法在30天法定期内完成该等个案的初步审查,因而导致5宗个案进入调查阶段。不过,即使不计入这5宗个案,2013年度进入调查阶段的交易申报比例仍上升至44%。

交易申报的撤回

另一方面,在进入调查阶段的48项交易申报当中,只有5项在调查开始后撤回,较2012年有20项申报在调查开始后撤回,数量急剧下降。2013年共有8项交易申报撤回,而当中只有一宗个案在2015年重新提交新的申报。根据2015年度报告,各方基于多种理由要求撤回交易申报,例如:(a)各方无法在30天的初步审查期或45天的调查期内处理所有CFIUS未解决的国家安全疑虑;(b)交易条款出现重大变动;(c)各方基于商业理由停止进行交易;(d)各方不愿意遵守CFIUS建议的补救措施;或(e)CFIUS建议总统暂停或禁止交易。撤回交易申报的数量下降,显示CFIUS认为有关的受监管交易不会影响美国国家安全,或更大可能是CFIUS与交易各方能够就补救措施达成协议。

中国排名首位

中国在美国的投资项目在2013年度连续两年成为经CFIUS审查的数量最多的受监管交易。2011年至2013年期间中国被CFIUS审查的受监管交易总数排名也超越了英国。

未来趋势分析

从2015年度报告可见,CFIUS可能要求受监管交易的各方采取某些补救措施,以减低CFIUS对外国控制的疑虑。虽然补救措施的范例清单仍大致上如2013年度报告所列,但明显增加了一些额外规定,显示CFIUS可能将会更严格地要求交易各方采取补救措施。具体而言,在2014年采取了补救措施的11项受监管交易中,最少有一宗交易的交易方被CFIUS要求给予美国政府“审查某些业务决定以及可在有关决定引起国家安全疑虑时提出反对的权利。”换句话说,此项补救措施让美国政府可参与这些外资公司的业务管理。

2015年度报告的“关键技术”一节所载的新研究结果,也显示CFIUS未来将会订立更严格的审查标准,尤其是针对涉及某些业务的受监管交易,而该等业务的所在地是位于有关政府被认为从事经济间谍活动的国家。与2013年度报告的总结有所不同的是,美国情报体系(“USIC”)目前认为某些外国政府或公司可能试图收购涉及研究、开发或生产某种关键技术的美国公司。“关键技术”一般包括美国军武清单下受管制的国防用品和服务、某些出口管制的军事、化学和生物武器、导弹及核能技术,以及标本和毒素。2015年度报告进一步说明,USIC“认为外国政府极有可能会继续使用一系列的收集方式以取得关键技术。”因此,CFIUS未来可能会对涉及关键技术的受监管交易进行更深入的严厉监察。

总结

虽然CFIUS解释其以 “逐案处理”的方式审查交易,但2015年度报告显示,CFIUS特别关注可导致中国投资者控制美国产业的交易。为避免不必要地使问题复杂化以至CFIUS在交易达成后进行监察,中国投资者如参与涉及“国家安全”的范围(被广泛界定)而可能导致美国产业受到外国控制(同样被广泛界定)的并购或收购交易,应仔细考虑自愿向 CFIUS作出申报。事实上,众所周知的是CFIUS人员通常会彻底搜索财经新闻,当他们发现有任何交易可被视为一项影响到国家安全的受监管交易时,他们大有可能会联系并要求交易各方提交申报,或甚至乎单方面展开审查。为确保能够顺利应对CFIUS的审查,交易各方应尽早在审查流程中提议补救方法,以解决上述提到的问题。

1 A.T. Kearney, 《2014年科尔尼外商直接投资信心指数:准备就绪》(The 2014 A.T. Kearny Foreign Direct Investment Confidence Index: Ready for Takeoff) 1 (2014),可在www.atkearney.com/documents/10192/4572735/Ready+for+Takeoff+-+FDICI+2014.pdf/e921968a-5bfe-4860-ac51-10ec5c396e95上查阅。

2 国际投资机构(Organization for International Investment),《对美国的外商直接投资》(Foreign Direct Investment in the United States) – 2014年报告 5 (2014),可在www.ofii.org/sites/default/files/FDIUS2014.pdf上查阅。

4 David Dollar, 《为何中美之间外商投资相对较少?》(Why So Little Investment Between the United States and China?), Up Front (Feb. 26, 2015, 1:42 PM), http://www.brookings.edu/blogs/up-front/posts/2015/02/26-investment-between-us-and-china-dollar.

5 50 U.S.C. App. §§ 2170(a)(3), (b)(A)(i), (f)(1)-(11)。已编入50 U.S.C. App. § 2170(f)的11项因素,一般分为三类:外商投资者的性质、目标公司是否容易受控制,以及交易对美国国家安全及全球安全的影响。