Director of Market Research | Fund Finance

Total secondaries market volume rose 48% in 2025, adding to the 45% increase reported for 2024, according to the Jefferies Global Secondary Market Review published earlier this week. Notably, LP volume reached a record $125 billion with 40% of transactions coming from first-time participants.

Another strong appearance by first-time LP sellers reflects not opportunistic rebalancing, but a structural response to prolonged cash-flow uncertainty that has extended private market duration beyond what conventional portfolio tools can absorb.

This note outlines the growing importance of LP-led secondaries in light of the ongoing distribution drought, the historic constraints inherent in the sale of private fund interests, and the outlook for growth. While capital circulation in private markets is likely to improve in 2026, LP-led secondaries are positioned to expand further given the inherent limitations of conventional portfolio duration management tools, structural evolution in transaction design, shifts in LP portfolio management, and the opportunity for fund finance to support liquidity.

Secondaries in Context

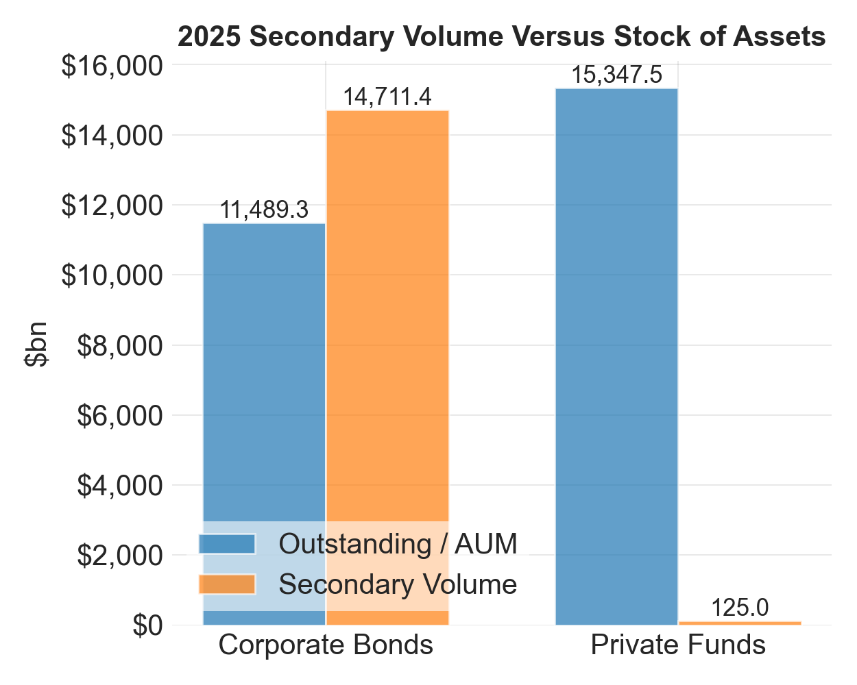

Secondaries break the norm in the relationship between primary and secondary markets next to just about any institutional asset class. Again, we are focusing on LP-led secondaries and comparing private market secondary volume to public markets.

Note: Secondary market volume for private funds includes LP-led transactions only.

Source: Jefferies, Preqin, SIFMA, and Cadwalader, Wickersham & Taft LLP.

The natural state of institutional markets is a robust secondary market generally exceeding volume in primary markets. But before concluding that private markets will simply converge to this state, it is important to understand the structural constraints that formed the current equilibrium.

Unique Constraints

The divergence between secondary market volume in public markets versus privates is explained by key structural constraints in the private funds market.

Liquidity value versus option value. For most LPs, a private fund interest embeds a valuable call option on future distributions. Selling that interest amounts to selling the call option in exchange for immediate liquidity. In normal conditions, the option value of waiting—preserving upside convexity and exposure to a better exit environment — exceeds the value of cash today. As a result, rational LPs supply secondaries only when liquidity value rises sharply due to external constraints such as capital calls, policy limits, or uncorrelated outflows. This keeps natural supply structurally low outside periods of stress.

Sponsor interest in supervising transfers and consents. Near and dear to subscription lenders’ hearts, GPs retain significant control over LP transfers through consent rights, KYC processes, and transfer restrictions embedded in fund documentation. This oversight is not merely administrative. Sponsors have an economic interest in preventing LPs from selling future upside at distressed prices, in limiting the introduction of misaligned or short-term holders, and in avoiding signaling effects that could affect fundraising or portfolio company outcomes. These frictions increase transaction costs, extend timelines, and reduce velocity, suppressing LP-led supply even when economics would otherwise justify selling.

Bid-side balance sheet constraints. Secondary buyers are balance-sheet constrained investors whose capacity is shaped by leverage availability, financing spreads, and advance rates on NAV and preferred facilities. When financing is cheap and abundant, buyers can absorb large volumes and accept narrower discounts. When rates rise or lending standards tighten, bid capacity contracts sharply. Because sellers tend to emerge precisely when liquidity is scarce, bid-side constraints are procyclical, preventing volume from scaling when it is most needed.

Information asymmetry. In LP-led transactions, buyers underwrite opaque assets with limited visibility into underlying portfolio company performance, exit timing, or GP intent. NAV is a reference point, not a binding valuation, and distribution timing is path-dependent on sponsor decisions rather than market observables. Buyers therefore demand compensation for underwriting uncertainty, while sellers, facing liquidity pressure, often perceive this discount as excessive. This asymmetry widens bid/ask spreads and suppresses transaction flow even when both sides are economically motivated to trade.

Price discovery without scale. Unlike public markets, the secondary market clears primarily through price rather than volume. When supply increases, discounts widen instead of throughput expanding. Each transaction resets reference prices, but does not generate continuous flow. This mechanism allows the market to discover value episodically without ever achieving depth or liquidity comparable to primary markets. As a result, secondary pricing can adjust rapidly, but market scale remains structurally capped.

Delayed Distributions Defy Conventional Duration Hedging Tools

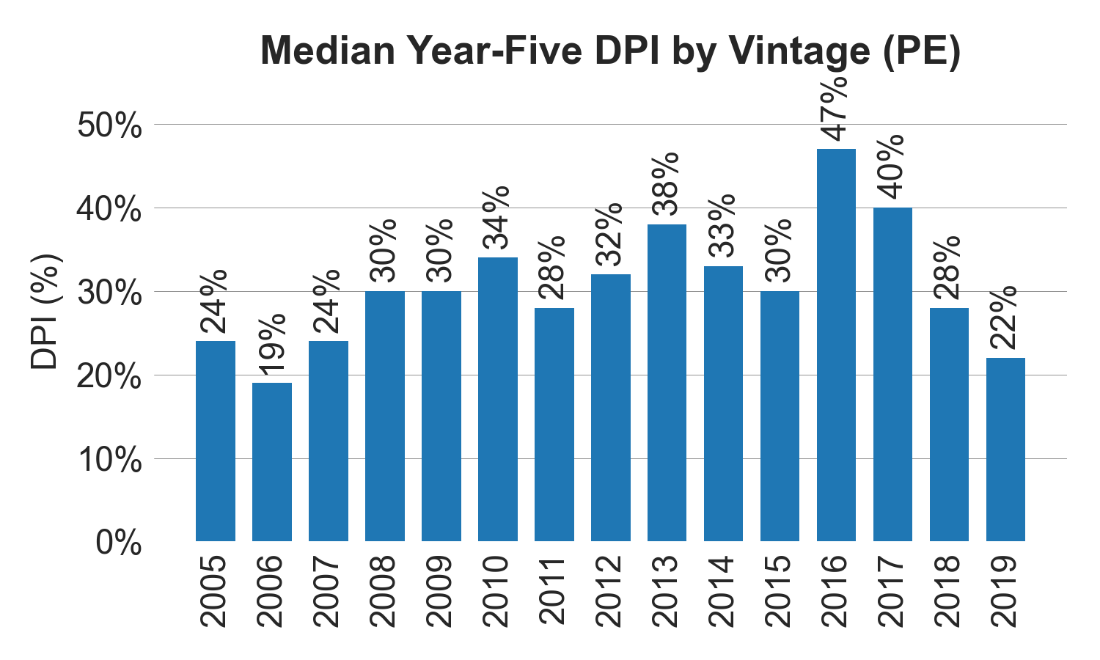

The distribution drought has mechanically pushed private investment cash flows further into the future, creating portfolio management challenges that conventional duration tools cannot solve.

Source: Preqin.

The slowdown in exits and refinancings has delayed the return of capital, extending the weighted average life (WAL) of private market portfolios even where NAV remains stable or rising. This is not a valuation problem but a timing problem: principal is simply not coming back on the expected schedule. As WAL extends, capital remains locked in private funds longer than planned, reducing portfolio flexibility and increasing sensitivity to liquidity pressures elsewhere on the balance sheet. While closed-end fund investments can be decomposed conceptually into bond-like interest and principal cash-flow streams, the absence of predictable timing prevents effective replication with fixed-income hedging instruments.

Conventional duration management tools are designed to hedge interest rate exposure on known cash flows, not the timing risk embedded in private market distributions. Payer swaps assume known notionals, known payment schedules, and stable exposure. In private portfolios, none of these conditions hold. Distribution timing and size are stochastic and path-dependent on exits, refinancings, and sponsor behavior, making stable hedge ratios impossible. Options and swaptions face the same limitation once exercise timing depends on GP decisions rather than market observables. As a result, synthetic hedging tools cannot reliably offset the liquidity risk created by delayed distributions.

At this point, it may be helpful to distinguish between duration and WAL. Duration references the weighted average timing of all discounted cash flows (in this case, preferred return plus remaining distributions), while WAL references the expected timing of principal recovery. While we’ve been referencing duration, WAL is therefore more relevant in this context because it is the uncertain notional amount and timing of distributions beyond the preferred return. For LPs, it is WAL extension, not rate duration, that creates the binding portfolio problem.

Framing the problem in terms of WAL rather than duration clarifies why payer swaps can be counterproductive. To hedge long-term timing risk, payer swaps introduce certain near-term cash outflows in the form of fixed payments, increasing short-term liquidity pressure at precisely the moment when distributions are weak. In effect, the LP swaps uncertain future inflows for certain current outflows, tightening liquidity rather than relieving it.

In practice, this means LPs manage private market portfolio duration structurally rather than through derivatives. Commitments, pacing, portfolio construction, and increasingly secondary market activity become the only effective levers. LP-led secondaries are therefore not opportunistic liquidity events, but a structural response to WAL extension and one of the few tools available to actively shorten private portfolio duration when cash flows stall.

So Just Break It in Two?

An LP-led secondaries transaction splits a hypothetical ten-year closed-end fund investment into two shorter-duration cash flows, which seems like an intuitive answer to WAL extension. But before attaching weight to this “just-break-it-in-two” solution, it is important to decompose the economics embedded in secondary pricing.

An LP-led secondaries transaction can be framed as the sale of an option. Specifically, the seller is selling a call option on cumulative future distributions, with exercise timing controlled by the GP and payoff realized only when exit conditions permit. The seller generally negotiates this option sale under liquidity pressure. The buyer is underwriting opaque timing and value risk and requires compensation for this uncertainty. Added to this, the timing of distributions sits outside the control of both seller and buyer.

In selling its call option, the seller gives up upside convexity, while the buyer acquires a long-dated, slow-decaying option with long volatility exposure. For the seller, the decision to transact is therefore a tradeoff between letting go of a valuable call option in exchange for immediate liquidity.

This framework helps explain why secondary pricing can appear disconnected from NAV. The clearing price reflects the seller’s shadow discount rate — the internal rate at which uncertain future distributions are converted into immediate liquidity. This rate is driven by liquidity urgency more so than asset value and may be influenced by uncorrelated outflows (e.g., pension payments), the denominator effect, capital calls (or other liquidity needs) elsewhere, opportunity costs, and governance constraints.

Against this, in selling its call option, the seller is also assessing the accuracy of NAV and the distant timing of exits and distributions. A transaction occurs when the secondary price exceeds the LP’s subjective value of the call option given its prioritization of near-term liquidity.

At the market level, this explains why LP-led secondary volume is episodic, why discounts widen under stress, and why buyers can earn structural alpha by being paid to warehouse optionality.

The pricing dynamic explains why simply creating two shorter-lived cash flow streams through a secondary sale overlooks underlying complexities.

Where There’s a Problem There’s a Structure

The Jefferies secondaries market report points to structuring evolution to balance LP demand for liquidity while preserving AUM, GP relationships, and optionality. Deferred pricing, used in 23% of LP transactions in 2025, is one such development.

In a deferred pricing transaction, the seller splits the call option sale into two legs:

- Base consideration, paid at close, priced conservatively, and designed to meet immediate liquidity needs.

- Deferred consideration (earn-out), tied to realized distributions, exit multiples, or NAV outcomes, often capped and time-limited.

This structure allows the seller to retain upside exposure while realizing liquidity, narrowing the bid/ask gap and enabling transactions earlier in the cycle rather than only under stress.

TPA Can Change the Math

The growth in LP-led secondaries volume in 2025 shows an LP preference for liquidity and a willingness to sell call options to get there. For 2026, accommodative fiscal and monetary policy combined with high public equity and fixed-income valuations are aligned to improve private market circulation and relieve near-term liquidity urgency. At the same time, structural shifts may support continued growth in LP-led secondaries.

In November, CalPERS became the first U.S. pension fund to join CPP Investments, New Zealand Super, and the Future Fund in adopting a Total Portfolio Approach (TPA), pivoting away from strategic asset allocation (SAA) toward whole-of-portfolio objectives. Under TPA, liquidity is no longer a residual outcome of asset class allocations but an explicit portfolio objective. This effectively raises the shadow discount rate applied to delayed private-market cash flows, lowering the threshold at which selling becomes rational even outside periods of stress.

A 2025 study by the Thinking Ahead Institute found that 16 of 26 surveyed asset allocators plan to move toward TPA over SAA. If this trend continues, liquidity value in private portfolios may rise structurally, increasing secondaries engagement even as market conditions normalize.

Where to Now?

The secondaries market is a significant source of NAV lending collateral. As LP-led volume grows and pricing becomes more continuous, the market deepens the pool of financeable NAV, reinforcing a feedback loop between secondary liquidity and fund finance capacity. Here’s how the pieces fit together:

- Capital circulation in private markets may improve in 2026, easing near-term liquidity urgency.

- The deferred distribution experience of the past three years has altered how LPs perceive private fund duration in ways conventional tools cannot address.

- The secondary market is evolving toward structures that support more consistent through-the-cycle volume.

- Wider adoption of TPA may structurally increase demand for immediate liquidity across private portfolios over time.

Taken together, we expect continued growth in LP-led secondaries and a gradual shift toward a more durable, less crisis-driven secondary market.