Search Results

With four major interest rate benchmarks ceasing to be published by the end of last year, we thought now would be a good time to provide a refresher on alternative currency rates. In this article we first discuss the key shifts that occurred to transition to more robust benchmarks for Canadian dollars, Singapore dollars, Japanese yen and Mexican pesos. We then examine the ongoing relevance of the base rate conventions for Euros, Sterling, Australian dollars, Hong Kong dollars, New Zealand dollars, Danish krone, Norwegian krone, Swedish krona and Swiss francs. With this information, you’ll be prepared to manage any related provisions in your fund finance transactions.

Liquidity solutions are a topic du jour in fund finance. With bank balance sheets somewhat restricted by macroeconomic concerns and risk-weighted asset regulations, fund finance borrowers and lenders have sought creative ways to put capital to work. One construct that may open up this optionality is the tranche B facility, a subordinated line of credit that sits within the same transaction as a senior revolver or term loan. This article explores the basic tenets and nuances that may be negotiated for constructing a tranche B facility in your deals.

Although we all still remember the after effects of the 2007-08 financial crisis, we’re actually still feeling the impact of the Great Depression in our loan documents. The Crash of ’29 was precipitated in part by margin lending, a popular tool in the early 1900s to enhance infrastructure investments by allowing the purchase of stock with borrowed funds where the stock acted as collateral for the loan. A rush on margin calls as stock prices collapsed wiped out fortunes and eventually led the Federal Reserve Board to issue margin regulations. Better known to fund finance practitioners as Regulations T, U and X, they appear almost universally in our credit agreements and opinions. This article provides an introduction to these regulations and how they may be related to fund finance transactions generally. Although note that certain fund finance transactions require a deeper dive into the margin regulations. Stay tuned!

The doctrine of sovereign immunity is a foundational element of the interplay between a governmental investor’s contractual obligation to satisfy capital calls and a fund’s or lender’s ability to enforce that obligation against the investor. We recently completed our comprehensive series on sovereign immunity across all fifty states of the United States, as well as England and Wales and a cameo from the Cayman Islands. In this article we look at the rest of the world. We assess key statutory and equitable principles, deconstruct how to satisfy judgments against foreign sovereigns and peruse related side-letter provisions so you can understand how to mitigate the risks of these international investors in your fund finance facilities.

As we finish the last season of LIBOR replacement, the fund finance market is busy amending our loan documents to include SOFR as the interest rate benchmark for U.S. dollar loans. While the cessation date for USD LIBOR is June 30, 2023, the deadlines for the continuing IBOR benchmarks for other currencies are more of a mixed bag. In this piece we analyze the current state of play of the alternative currency benchmark rates to equip you with the information you need to assess their use in your facility documentation.

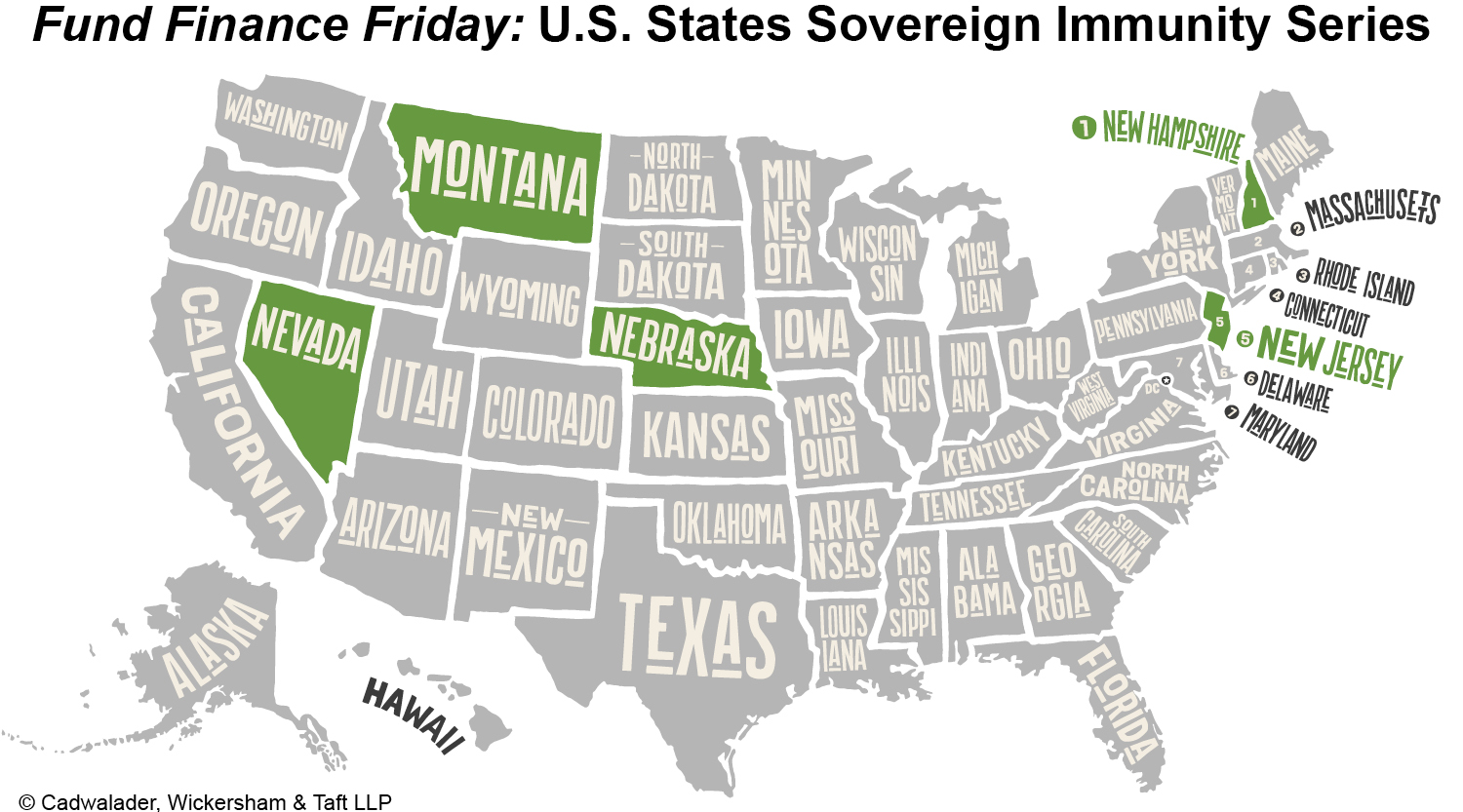

Today’s article marks the halfway point in our alphabetical 50-state survey of sovereign immunity, as this installment covers Montana, Nebraska, Nevada, New Hampshire and New Jersey.

As the private equity and fund finance markets continue to expand with new, innovative products, collateralized fund obligation transactions, or CFOs, are becoming increasingly popular. A panel of experts discussed the nuances of constructing CFOs, from the asset-based lending nature of the rated notes that underpin these deals to the complexity of cash flows, liquidity needs and legal considerations.

As the traditional subscription facility market has matured, new liquidity and funding innovations have arisen. Enter the rated note feeder. This structural tool in the back pocket of GPs may ease the accessibility of private equity to investors that need to commit capital via a debt commitment and enhance investor returns through collateralized fund obligations. While the use of rated note feeders has gained significant traction over the last couple of years, implementing this structure in connection with a credit facility is fraught with questions. This article provides a background on rated note feeders against the backdrop of fund finance, discusses issues of enforceability in the event of a fund bankruptcy, and dissects the nuances of protective provisions you can use for a rated note feeder in your next fund finance deal.

As interest rates rise and a potential recession looms, we’ve seen a flight to quality as new entrants seek to participate in our fund finance market. While most deals on our books have just one lender and one fund as borrower, multi-lender facilities have historically provided outsized loan commitments. To wit: of the nearly 900 new deals and rebooking amendments our U.S. fund finance team did last year, only 8% were syndicated on initial close. Yet of the almost $200 billion of lender commitments in our U.S. portfolio during that time, almost two-thirds came from syndicated credit facilities. A significant part of that disparity comes from new lenders joining deals after origination. We expect that trend to continue. This article assesses the elements, issues and hot topics for bringing new lenders into a transaction from the perspective of the borrower, the administrative agent and the incoming lenders.

The Thursday afternoon panel on “Hot Topics in Fund Finance” was chock full of interesting insight on the latest trends in our industry. Subjects included ESG, rated note feeders, continued LIBOR transition and the competition for talent in the market.

« Previous | Next »