February 20, 2025

We have been waiting to see how things are shaking out for the now-beleaguered Consumer Financial Protection Bureau (“CFPB”). A month out from Trump’s inauguration, we are still in a position of wondering if there will be a future for the agency in this administration.

Formally dismantling the CFPB would require Congress to act, of course, but the new administration has already taken extreme steps to defund the agency and reduce its workforce. After initially appointing the Secretary of Treasury, Scott Bessent, as of January 31st as the Acting Director of the CFPB, Trump eventually appointed Russell Vought, the Director of the Office of Management and Budget, as the Acting Director, which was approved by the Senate on Friday, February 7th. In line for the permanent Director position is Jonathan McKernan, a former member of the Board of Directors of the Federal Deposit Insurance Corporation (“FDIC”), whom Trump appointed on February 11th. The Senate has yet to vote on approving McKernan’s appointment. McKernan has a strong regulatory background in financial services, having worked at Treasury and the Federal Housing Finance Agency, as well as serving as counsel to Ranking Member Pat Toomey (R-PA), who sits on the Senate Committee on Banking.

In addition, as of February 14th, the District Court for the District of Columbia approved a temporary restraining order (“TRO”) in a case brought against Acting Director Russell Vought by the National Treasury Employees Union, among others. The TRO not only prevents Vought from destroying CFPB data, terminating CFPB employees except for cause, and transferring, relinquishing, returning or reducing “the amount of money available to the CFPB . . . other than to satisfy the ordinary operating obligations of the CFPB." The next hearing in the case has been set for March 3rd, during which the court will consider turning the TRO into a preliminary injunction.

Against this backdrop, the activities of the CFPB have ground to a complete halt, with Vought directing CFPB employees to engage in no work. So, what does this mean for the industry?

The CFPB is the primary consumer financial services regulator at the Federal level. It has primary responsibility for supervision of and enforcement against banks, non-banks and service providers. The CFPB has sole responsibility for interpreting laws like the Truth In Lending Act and Regulation Z, and the Electronic Funds Transfer Act and Regulation E (the “Alphabet Regs”). This means that without legislation to amend the Consumer Financial Protection Act (“CFPA”), no other agency will be able to engage in rulemakings related to these laws. Further, there is another section of the CFPA that also gives the CFPB exclusive authority to “issue guidance” regarding these laws, as well as a broader set of consumer financial marketplace issues. Effectively this means that no other Federal agency is even able to put out industry guidance on most consumer financial protection concerns.

As many commenters have pointed out, it is true that there are several Federal agencies that have concurrent abilities to not only enforce the consumer financial services “Alphabet Regs”, but also to enforce the unfair, abusive or deceptive provisions of the CFPA. Each of the Federal Reserve, FDIC, Office of the Comptroller of the Currency, National Credit Union Administration and the Federal Trade Commission (“FTC”) may engage in such enforcement against the entities under their jurisdiction. And, the prudential regulators (i.e., not the FTC) have the ability to examine and supervise banks for compliance with consumer financial services laws. But, as noted above, none of these Federal agencies may interpret the Alphabet Regs, change them or issue guidance regarding them.

Additionally, the FTC has what is called “remainder jurisdiction” over financial services entities – they can bring enforcement actions against any financial services entities except banks, credit unions and insurance companies. So they, in effect, are now the only Federal agency that can enforce consumer financial services regulations against fintechs, credit bureaus, mortgage brokers and payday lenders. The FTC has no supervisory capabilities and it is an agency subject to Congressional appropriations, meaning that they make do with a slender budget, especially as compared to the prudential regulators and the CFPB. Even if the newly appointed FTC Chairman, Andrew Ferguson, was zealous about enforcing consumer protection laws, the FTC would not be able to cover more than just a small fraction of what the CFPB covered.

In addition to these concurrent capabilities at the Federal level, the state attorneys general are also empowered to enforce the CFPA and the consumer financial services laws “with respect to any entity that is State-chartered, incorporated, licensed, or otherwise authorized to do business under State law.” With respect to national banks or Federal savings associations, the state AGs can enforce the Alphabet regs, but may not enforce the CFPA against them. This could mean that state AGs are likely to take more interest in addressing lending problems themselves. And even if the CFPB is partially restored to working order, we can expect New York and California to drive a lot more of the national conversation on consumer financial services laws throughout this administration.

If the CFPB were effectively shuttered for the next four years, banks and credit unions would likely face more uneven enforcement of the consumer financial services laws at the hands of the states. Also, banks and credit unions would be subject to consumer financial services compliance examinations and supervision by their prudential regulators, which is how it worked prior to the passage of the CFPA. The prudential bank regulators are famously less concerned about consumer financial services compliance and will most certainly be rusty in addressing these issues themselves, which likely will lead to uncertainty and uneven supervision, as well. Importantly for the industry, this means that non-banks would no longer be subject to supervision, which is something that leveled the playing field for over-regulated banks.

So, while this all may seem like “a break” for banks and the consumer financial services industry, for the financial services companies that are interested in being responsible about compliance, this “break” will be accompanied by a high degree of uncertainty as to where potential enforcement actions could be coming from and on what issues. And for the companies that are not interested in being responsible about compliance, this breakdown in enforcement, regulation and supervision could end up being a field day that could significantly harm consumers well before any of the other regulators and enforcement agencies have had a chance to realize what is happening, which could be very bad for the economy overall.

As set out in our previous Cabinet News & Views issue of December 2024 here, the Court of Appeal has found that some commissions paid to car dealerships for arranging loans were potentially unlawful as the loan agreements did not disclose the amount of commission the lender was paying to the broker with sufficient clarity, and adequate customer consent was not received.

The Court of Appeal also held that, in certain circumstances, lenders would be liable as principals. As noted at the time, there are concerns that these issues may have a wider implication for other consumer credit loans, and the need for finance providers to recognise and forecast for provisions for potential compensation.

The UK Treasury had applied to make representations when the Court of Appeal’s decision is appealed by the Supreme Court in April 2025. Though the Supreme Court has been refused this right, it is still open to the Financial Conduct Authority to intervene.

Pending the hearing of that appeal, our recommendation would be to continue to provide for potential liability when dealing with consumer lending, and we will continue to update following the Supreme Court hearing in April.

On February 12th, the White House announced numerous nominations to be sent to the Senate. The large list of nominations included three nominations for financial regulators. President Trump is nominating, Jonathan Gould to be Comptroller of the Currency, Brian Quintenz to be Chairman of the Commodity Futures Trading Commission (“CFTC”), and, as mentioned elsewhere in this week’s Cabinet News & Views Newsletter, Jonathan McKernan to be the Director of the Consumer Financial Protection Bureau.

Mr. Gould previously served as Chief Counsel at the Office of the Comptroller of the Currency (“OCC”) during the first Trump administration. He is currently a Partner at a global law firm. In his previous time with the OCC, Mr. Gould took a leadership position in many fintech and crypto initiatives. Rodney Hood, a former Chair of the National Credit Union Administration, is the current Acting Comptroller of the Currency.

Mr. Quintenz is currently the head of policy at a crypto venture capital firm, a16z Crypto. He was previously a Commissioner at the CFTC in the first Trump administration. Mr. Quintenz’s crypto bona fides suggest that the CFTC may be the “winner” in the turf battle between the Securities and Exchange Commission and the CFTC. Commissioner Caroline Pham is the current Acting Chair of the CFTC.

A recent High Court judgment[1] in a case where NatWest won a claim against CMIS arising under derivative transactions raises several issues of law with practical implications for the structuring of complex finance deals. Notably, the case looked at the distinction between a contact of guarantee and a contract of indemnity and also analysed the question of when a payment is “due".

The Dispute

The dispute centered on deeds (the “Deeds”) granted by CMIS in favour of NatWest in respect of certain swap payments (i.e. the Notional Adjustment Payments and Subordinated Step-Up Amounts) that might become payable to NatWest by SPVs established to securitise mortgage loans originated by CMIS (the “EMAC Issuers”). The Deeds provided that CMIS would pay to NatWest “EMAC Indemnifiable Amounts” (defined by reference to those swap payments) as from the date such amounts are due under the swaps. Such “EMAC Indemnifiable Amounts” arose from the periodic adjustment of the swaps, the mark-to-market (MTM) value of which rose from £1.8m in 2016 to £93m in 2017[2].

CMIS argued that the Deeds are guarantees rather than true indemnities and, because the terms of the swaps provided that the payment obligation of the EMAC Issuers to NatWest could be deferred, the EMAC Indemnifiable Amounts were not due or payable by CMIS until such time as the EMAC Issuers’ payment obligation ceased to be deferred.

Guarantee v Indemnity

In construing the Deeds and other securitisation documents together, the court adopted the approach of Lord Clarke in Rainy Sky v Kookmin Bank [2011][3] and Lord Hodge in Wood v Capita Insurance Services Ltd [2017] [4] where (i) the objective meaning of the language used by the parties has to be ascertained; considering what a reasonable person, who has all the background knowledge which would reasonably have been available to the parties, would have understood the parties to have meant; and (ii) if there are two available constructions, the court is entitled to prefer the construction that is consistent with business common sense that produces the more commercial result.

As the swaps were concluded between 2006 and 2008, the court found a lack of contemporaneous evidence of the commercial intention of parties. However, based on the facts, including that the Deeds were entitled 'Deed of Indemnity', the language used in the Deed was that of “indemnity” and that the obligation to pay EMAC Indemnifiable Amounts was a primary obligation, the court concluded that the Deeds were properly categorised as contracts of indemnity and not contracts of guarantee.

When is a payment “due”?

Having concluded that the Deeds were properly categorised as contracts of indemnity and not guarantees, the court turned to consider whether the EMAC Indemnifiable Amounts were “due” to be paid by CMIS under the Deeds.

This case is an important addition to the existing case-law on the legal effect of Section 2(a)(iii) of the ISDA Master Agreement, which makes payments subject to the condition precedent that no event of default has occurred and is continuing. That case-law draws the distinction between a debt obligation and a payment obligation. Section 2(a)(iii) has been litigated on a number of occasions. The court here considered Lomas & Ors. v JFB Firth Rixson Inc [2012] [5], quoting:

"[25] Section 2 of the master agreement is, however, all about the payment obligation and does not, in our view, touch the underlying indebtedness obligation. In particular, section 2(a)(i) obliges each party to make each payment specified in the confirmation and it is that payment obligation which is, by section 2(a)(iii), made subject to the condition precedent that no event of default has occurred and is continuing.

[28] A similar argument to that advanced by Mr. Fisher was submitted to Gloster J. by Mr. Jonathan Crow QC in Pioneer Freight Futures Co. Ltd (in liq) v. TMT Asia Ltd [2011] EWHC 778 (Comm) … a case about FFAs decided after the decision of Briggs J in the present case, at any rate in his oral reply (see [72]). It was rejected by her for much the same reasons as we have set out. She said (at [91]):

"Once one approaches the analysis on the basis that, under section 2(a)(iii), one is only looking at the payment obligation, rather than the debt obligation, the whole machinery makes sense. Thus the wording of section 2(a)(iii) makes it clear that the payment obligation is subject to the condition precedent that no Event of Default or Potential Event of Default has occurred "and is continuing". The natural reading of those words envisages that once a condition precedent is fulfilled, the obligation to pay revives. There is no need for any further creation of the debt obligation itself”

Following the same reasoning, the court concluded that, in the context of the Deeds, the word “due” refers to sums which are accrued due so that there is an existing obligation in debt irrespective of whether payment has been deferred and, therefore, the relevant swap payments were “due” even though the obligation of the EMAC Issuers had been deferred. It therefore followed that the EMAC Indemnifiable Amounts where “due” and had to be paid by CMIS to NatWest under the Deed.

Conclusion

This case is of significance in that it demonstrates:

- that even with well-established principles of interpretation, under long-dated deals concluded many years prior to a dispute, the commercial intention of the parties may not be easily ascertainable;

- the importance of, as far as possible, indicating the commercial context of the documents in recitals and of taking care to record and retain relevant contemporaneous communications relating to complicated structures. This may require exceptions to routine document destruction policies;

- the intention behind certain derivative payments in bespoke deals may be particularly difficult to untangle;

- the choice of title and language of a legal document may be taken into account in interpreting the parties’ intention as to its effect; and

- therefore, the importance of clear drafting when structuring and documenting complex securitisations cannot be overstated.

[1] https://www.bailii.org/ew/cases/EWHC/Comm/2025/37.html

[2] see p.39 of the judgment

[3] 1 WLR 2900 at [14], [21]–[28]

[4] AC 1173 at [8]–[14]

[5] 2 All ER (Comm) 1076

As previewed in our prior Cabinet News &Views issue here, the UK’s Accelerated Settlement Taskforce Technical Group has published its implementation plan for the first day of trading for T+1 settlement to be scheduled for 11 October 2027.

This date is for settlement of UK cash securities, and will require the UK’s government to first amend the UK Central Securities Depositories Regulation. The implementation programme also sets out a Code of Conduct which includes the scope, a timetable and recommended behaviours for UK market participants, covering 12 “critical actions” in four business areas that must be implemented in order to ensure that settlement on T+1 can occur in a sustainable manner.

This Code of Conduct, which should be implemented by the end of 2027, covers both recommended actions and expected behaviours. The former sets out required operational changes, and the latter includes a commitment to compliance that creates an efficient and lower risk operational environment.

Note that current exemptions applying to transactions negotiated privately but executed on a UK trading venue as well as those executed bilaterally but reported to a UK trading venue are recommended to remain in place.

Highlights:

- Stablecoins are likely to be characterized as general intangibles under the UCC of non-Article 12 states.

- To the extent that non-Article 12 UCC applies to characterizing stablecoins in a transaction, upstream security interests may continue to attach to stablecoins received downstream and make them vulnerable to upstream creditors.

- Characterization of stablecoins as CERs under Article 12 provides take-free rights, which better align with transacting parties’ expectations.

- Parties should consider structuring transactions to take advantage of Article 12 if possible. Tokenization platforms should consider implementing Article 12 mechanisms natively.

When you get change for a twenty at the gas station, you don’t expect that some unknown person has a claim on those bills and coins. When you make an electronic transfer from your checking account to pay a bill, the recipient of the funds expects the same. Parties expect such funds to be free and clear.

Under the Uniform Commercial Code (“UCC”), that’s true of “money” (as defined). Money has the privilege of “take-free” rights.[1] However, stablecoins are not “money” under the UCC.[2] If parties use stablecoins as currency in a blockchain transaction, that assumption of a take-free right may not be true. Someone else might have a security interest in the tokens you receive in your wallet. And that is a potentially big problem for transactions conducted on blockchains.

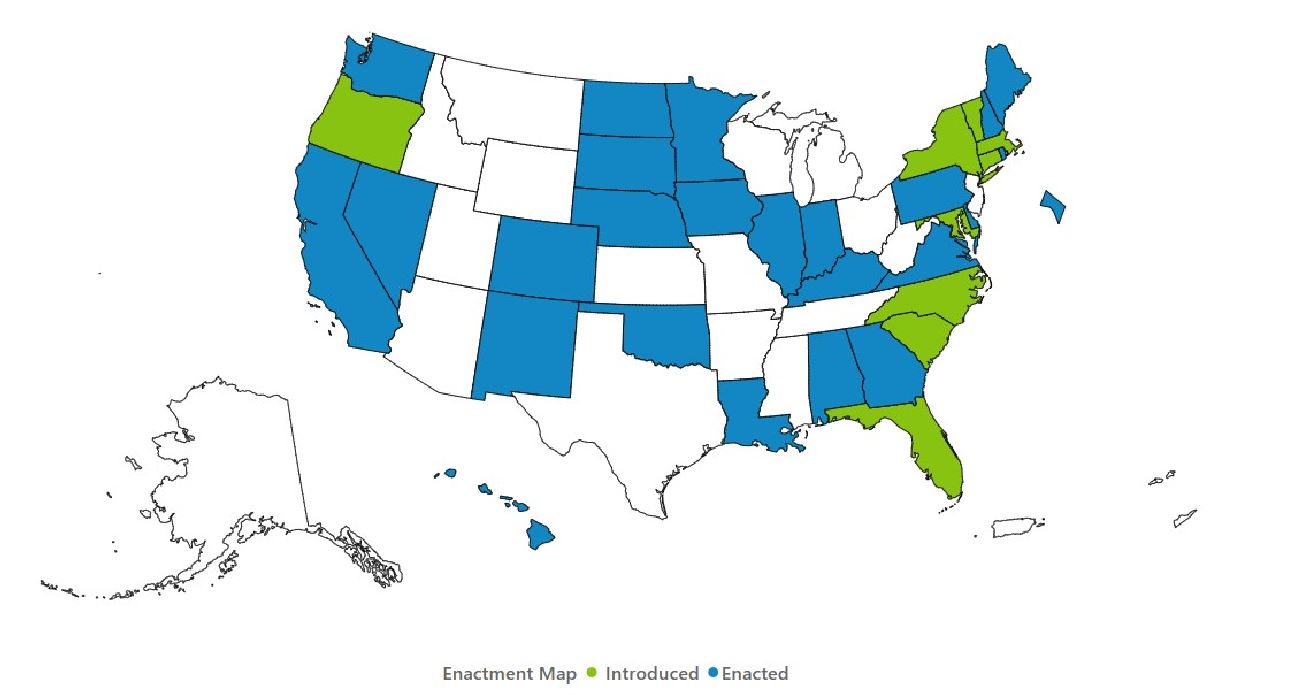

The trouble arises from the incomplete adoption of Article 12 and the 2022 UCC Amendments[3] by US states. As of this writing, 25 jurisdictions have enacted the amendments and 9 states have introduced legislation to do so.

Source: Uniform Laws Commission

This patchwork map introduces knotty choice of law issues in applying the UCC to digital assets.

New Article 12 of the UCC and the other changes included in the 2022 Amendments are designed to impart greater precision and certainty to digital assets—and they do. The signal innovation of Article 12 is the creation of the controllable electronic record (“CER”). CERs are, in essence, electronic records that can be subjected to a specially-defined type of control.[4]

CERs are a species of general intangible, but one to which the 2022 Amendments impart special rights—notably for this discussion, a take-free right available to “qualifying purchasers.” (A qualifying purchaser is a purchaser that obtains control of the CER for value, in good faith, and without notice of a claim of a property right in the CER).[5]

Stablecoins, as well as other digital tokens, are likely to be characterized as CERs under Article 12 (although the UCC analysis is not necessarily so simple or reflexive[6]). As such, qualifying purchasers of stablecoins might get take-free rights in their stablecoins, if the relevant UCC applicable to the transaction has been amended for Article 12.

Under the pre-2022 Amendment UCC, however, stablecoins and other digital tokens are just garden-variety general intangibles. The general rule under the UCC (both pre- and post-2022 Amendments) is that perfected security interests that are attached to general intangibles in the hands of a transferor continue in those general intangibles in the hands of a transferee.[7]

Stablecoins are attractive for use as an on-chain currency precisely because they are a simple[8] and understandable stand-in for fiat—indeed, their insulation from the wild volatility of other crypto has made stablecoins the “killer app” of on-chain financial transactions. But transaction parties may well not recognize that, unlike UCC “money”, the stablecoins they receive in a transaction might theoretically be encumbered.

The mischief this can create can be illustrated with a simple hypothetical. Let’s say that Party A has a secured credit facility under which it has granted to Lender A a perfect lien on all of its assets—including all general intangibles. Let’s say that Party A and a Party B engage in a blockchain transaction in which Party A transfers stablecoins to Party B. Party B then in turn transfers the stablecoins to a Party C.

And finally, let’s assume that Party A, Lender A, Party B and Party C are all LLC’s organized in non-Article 12 jurisdictions (Texas, say), and that all the documents applicable to the situation are governed by the law of a non-Article 12 state and choose forum as that non-Article 12 state (New York, say). Would Lender A’s security interest continue in the stablecoins that are now in Party C’s hands?

A New York court would likely find that, under the basic rules of the pre-2022 Amendment UCC, the answer would be yes. First, the court would likely characterize the stablecoins as general intangibles.[9] Second, the court might look at the “debtor’s jurisdiction” of Party C and conclude that it is Texas—a pre-2022 Amendments UCC jurisdiction.[10] Applying that law, the court would conclude that pre-2022 Amendments UCC rules would apply. The general rule under UCC §9-315[11] would seem to say that Lender A’s security interest would continue in the stablecoins in Party C’s hands.

So what would happen if Party A defaults on its loan, or files bankruptcy? Party C may well get a knock on the door from Lender A or the bankruptcy trustee, politely suggesting that the stablecoins in Party C’s wallet are Lender A’s collateral, and that they’d like them back.[12]

Party C would have been well advised to run UCC searches against Party B and Party A, checking for liens against general intangibles. But the feasibility of doing so assumes that Party C had the needed information—and if the parties only had identified themselves to each other by hexadecimal public blockchain addresses, running a UCC search may not have been possible.

If we vary the hypothetical, however, and make Party C a Delaware LLC and the chosen law and forum for all documents Delaware, the situation changes. Delaware has adopted Article 12 and the 2022 Amendments. The Delaware court would look to Delaware as the debtor’s location of Party C, and apply Delaware’s rules for perfection, effect of perfection and priority. Assuming that the stablecoins were characterized using Delaware’s UCC rules—that is, as probably constituting CERs[13]—and assuming that Party C is a qualifying purchaser, then under the Delaware UCC Party C would have a good case that it takes the stablecoins free of any property interest, including Lender A’s security interest.[14]

Article 12 is still very new and untested. It is possible that the preceding analysis might turn out differently in actual cases—and smart UCC lawyers might differ with aspects of my thinking and reach different conclusions. At the very least, though, these are conversations we should be having.

UCC choice of law may seem like a dry and academic subject. However, parties engaging with digital assets like stablecoins (whether parties to deals executed on blockchains, tokenization protocols or DeFi platforms) might suddenly find it all too exciting.

The incomplete state of adoption of the 2022 Amendments creates a situation where the application of divergent state UCC’s can potentially have wildly different results for transaction parties. At least until the “Uniform” Commercial Code is once again uniform, transaction parties should seek to structure their deals to minimize these risks, and tokenized RWA-leaning projects (like specialized RWA L-1’s and DeFi protocols) might consider natively implementing solutions to help deal with them.

Much time, effort and money is expended by blockchain participants on other security issues—like cyberattack vulnerability and smart contract risk. If a deal or a protocol is blown up because deadbeat upstream holders put liens on tokens, the parties that deal or developers of that protocol might ask themselves why they didn’t also consider Article 12 structuring to mitigate these UCC risks.

The views expressed in this article are solely those of the author, and are not necessarily those of Cadwalader, Wickersham & Taft LLP. This article is not legal, tax or investment advice.

[1] See UCC §§ 9-332(a) (take free right of transferee of tangible money), (b) (take free right of transferee of funds from a deposit account). Unless otherwise indicated, references to the UCC are to the UCC as amended by the 2022 Amendments.

[2] See “Mo’ Money Mo’ Problems: More on the Changes to the UCC’s Definitions of Money – UCC 9-102(a)(54A) – Part Four”, Cadwalader Cabinet News (Dec. 5, 2024) https://www.cadwalader.com/fin-news/index.php?eid=845&nid=115&search=money

[3] Uniform Law Commission, American Law Institute, Uniform Commercial Code Amendments (2022) (2022).

[4] UCC §12-102(a)(1).

[5] UCC §12-102(a)(2).

[6] I consider some of the issues with UCC characterization of digital tokens here: “Tokenized Assets as Collateral—You Need to Look Inside.” https://www.linkedin.com/posts/christopher-mcdermott-9bb18714_tokenization-tokenizedsecurities-tokenizedassets-activity-7256685087562305536-d2wP?utm_source=share&utm_medium=member_desktop&rcm=ACoAAALfiN8BRUh_zEuGlCMZeQ4l2OjaaflPN-U

Stablecoins might, for example, be characterized under Article 12 as “controllable payment intangibles”, although the analysis in that case might be similar as for CERs.

[7] UCC §9-201(a) (security agreement effective against purchasers of collateral and against creditors); UCC §9-315(a)(1) (security interest continues in collateral notwithstanding disposition). (Note that continuity of perfection of a security interest in stablecoins constituting proceeds would be subject to other rules in UCC §9-315.)

[8] Of course, stablecoins may not in fact be so simple, for many reasons. I recently ruminated on some of those reasons (inconclusively). “Can Your Grandma Buy Undies With USDC? And Other Important UCC Questions About the Blue Stablecoin,” (Paragraph: https://paragraph.xyz/@article12man/can-your-grandma-buy-undies-with-usdc?referrer=0xD5A8045b065153c1F961152E9c193fCDF77d7dEd LinkedIn: https://www.linkedin.com/posts/christopher-mcdermott-9bb18714_can-your-grandma-buy-undies-with-usdc-activity-7276071025941917696-n2vJ?utm_source=share&utm_medium=member_desktop&rcm=ACoAAALfiN8BRUh_zEuGlCMZeQ4l2OjaaflPN-U )

[9] I made the hypothetical easy by assuming all potentially applicable UCC’s are pre-2022 Amendment UCC’s. Whether the stablecoins would be characterized as CERs if the transaction straddled both Article 12 UCC jurisdictions and non-Article 12 UCC jurisdictions is an excellent question—and one to which I do not offer an answer here.

[10] See NY UCC §9-301(a).

[11] “Except as otherwise provided in this article and in Section 2--403(2):

(1) a security interest or agricultural lien continues in collateral notwithstanding sale, lease, license, exchange, or other disposition thereof unless the secured party authorized the disposition free of the security interest or agricultural lien; and

(2) a security interest attaches to any identifiable proceeds of collateral.”

NY UCC §9-315(a).

[12] The transparency of blockchain transactions may even make it easier for Lender A or the trustee to track down Party C.

[13] See footnote 9 above.

[14] “Rights of qualifying purchaser. — A qualifying purchaser acquires its rights in the controllable electronic record free of a claim of a property right in the controllable electronic record.” Del. UCC §12-104(e).

Cadwalader partners Mercedes Kelley Tunstall and Peter Malyshev recently spoke with Wired and Bloomberg, respectively, about the evolving relationship between banks, cryptocurrency, and financial regulations.

Cadwalader partner Mercedes Kelley Tunstall spoke with Wired about the complicated relationship between banks and #crypto in an article, "Chokepoint 2.0: An Investigation Promises the Truth About Crypto's Biggest Conspiracy," published February 18.

In the crypto space, it can be very difficult to obtain ordinary financial services from banks. Many crypto companies have reported having a hard time finding a bank willing to even open a checking account for them. This problem has led to many in the industry claiming that there is a conspiracy by the federal government to cut the crypto industry out of the banking system.

While most agree that banks are reluctant to do business with crypto-related organizations, experts have offered other explanations for the phenomenon.

“I don’t believe that there was any conspiracy,” said Mercedes. “You’ve got a real concern about money laundering, fraud, and terrorist financing occurring with cryptocurrency.”

After FTX collapsed amid allegations of fraud, said Mercedes, the banks had particular reason for limiting the number of crypto clients they worked with: Both to protect themselves from the reputational risk associated with providing services to a company later revealed to be fraudulent and the operational risk tied to the possibility that other crypto businesses might become casualties in the FTX fallout.

“The banking industry is very gossipy,” she said. “I think there was maybe a crowd mentality driving [the unwillingness to work with crypto businesses] but not anything more nefarious than that.”

Read the full article here.

Cadwalader partner Peter Malyshev spoke with Bloomberg about cryptocurrency exchange Crypto.com inviting its U.S. users to “trade their own prediction” on sports events, including who would win the Super Bowl.

By adding markets for “yes” or “no” positions on the outcome of the NFL playoffs and college football bowl games, these swaps contracts appear to look and function like online sports betting, a characterization Crypto.com disputes.

While such hypothetical uses for sports swaps do exist, they are rare. “How many hot dog vendors will be buying and selling futures?” asked Peter.

Read it here.