This website uses cookies. By using this website, you agree to our Cookie Policy.

January 29, 2016

Cadwalader has one of the most experienced legal teams in Europe, the United States and Asia advising on the trading of secondary debt, claims and loan portfolio transactions globally.

Cadwalader, Wickersham & Taft LLP, a leading law firm to global financial institutions and corporations, has advised clients on US$12 billion of trades globally in 2015, involving secondary debt, claims and both performing and non-performing loan portfolio transactions.

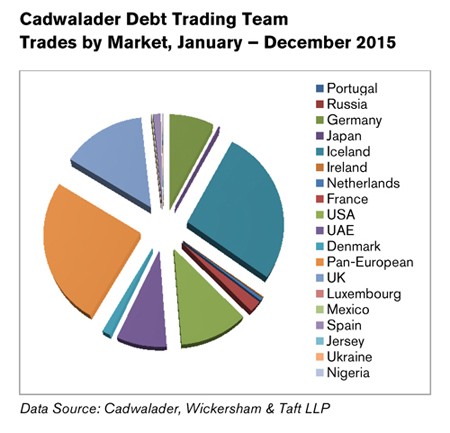

Led by partners Louisa Watt in London and Jeff Nagle in Charlotte, Cadwalader’s transatlantic debt trading team has advised clients on transactions involving a broad range of jurisdictions across Western and Eastern Europe, the USA and Latin America, Asia and Africa. Markets with the most activity include Iceland, Spain, France, Germany, UK and USA. See charts below for more information.

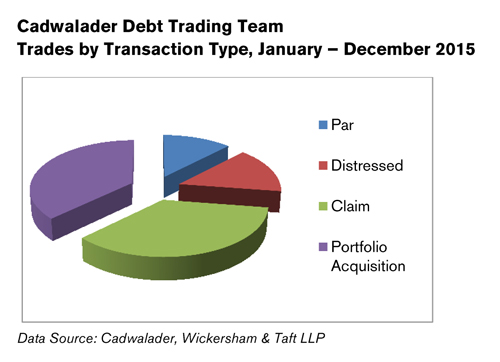

Louisa Watt commented: ‘Working with our clients across Europe and the United States, Cadwalader has seen an increase in loan portfolio acquisitions in the last 12 months as investors continue to focus on real estate and shipping.’

Cadwalader’s global debt trading team advises financial institutions and investment funds on all aspects of secondary loan acquisitions, from participations in traditional syndicated and bilateral loan trading positions globally, through to multi-billion Euro and US dollar loan portfolio transactions.

Additional Information