This website uses cookies. By using this website, you agree to our Cookie Policy.

Revisions to the Securitisation Framework: Second Consultative Document published by the Basel Committee

February 24, 2014The Basel Committee on Banking Supervision (the “Basel Committee”) has published a second Consultative Document containing revised proposals for the Basel securitisation framework (the “Revised Proposals”).1 The Revised Proposals describe a revised set of approaches for determining the regulatory capital requirements in relation to securitisation exposures held in the banking book and include a draft standards text. Market participants will be taking a keen interest in these proposals, which are summarised below.

Background

Under the securitisation framework established under Basel II,2 banks are required to hold regulatory capital against all their securitisation exposures (including those arising from the provision of credit risk mitigants, investments in asset-backed securities, retention of subordinated tranches, and the extension of liquidity facilities and credit enhancement).

The existing framework contains two different approaches, depending on whether the banks use the standardised approach or the internal ratings-based (“IRB”) approach for the applicable underlying exposures that are securitised. In both cases there are look-up tables setting out the relevant risk weights (generally these are lower in the IRB approach) depending on the rating (or inferred rating) of the applicable exposure. Alternative approaches may be used where ratings are not available or in certain other cases (including, in the case of banks which apply the IRB approach, a supervisory formula approach3).

The proposed changes are part of the wider reform of regulatory standards following the financial crisis. The Basel Committee has been carrying out a review of the securitisation framework with the objectives of reducing mechanistic reliance on external ratings, increasing risk weights for highly rated securitisation exposures, reducing risk weights for low-rated securitisation exposures, reducing cliff effects4 and making the framework more risk-sensitive.

In December 2012, the Basel Committee published the first Consultative Document on this topic,5 which contained a number of significant changes to the existing securitisation framework, including two possible hierarchies of approaches for determining the regulatory capital requirements for securitisation exposures held in the banking book, enhancements to the existing ratings-based and supervisory formula approaches, the introduction of a simplified supervisory formula approach, certain concentration ratio based approaches and a 20% risk-weight floor (the “Original Proposals”).6

Interested parties provided a number of detailed responses to the Basel Committee on the Original Proposals. Comments were made as to the calibration, the usability and the lack of risk sensitivity and capital neutrality7 of the proposed approaches, and concerns were expressed that the resulting increases in capital requirements would be unduly conservative and that this could have a detrimental effect on the securitisation industry and the broader economy. More details of the Original Proposals and a summary of the comments provided by market participants can be found in the Cadwalader Clients & Friends Memo entitled “What’s Next for the Basel Securitisation Framework” dated 9 May 2013.

Following its review of the comments received, together with the results of a quantitative impact study, the Basel Committee published the second Consultative Document with the Revised Proposals.

In developing the Revised Proposals, the Basel Committee has taken into account a number of the comments made, and has clearly expanded the scope of the relevant considerations compared with the Original Proposals. In particular, there is an increased focus on simplicity, and while retaining the principles of risk sensitivity and prudence, the Revised Proposals also indicate that there should be broad consistency with the underlying framework. Although the Basel Committee rejected a strict capital neutral approach, it did go so far as to say that capital charges for a securitisation should be broadly consistent with those of the underlying pool, particularly in the case of senior tranches. Another significant guiding principle is that banks should be able to use the best information available on the underlying pool of exposures and should be able to use diverse sources of information.

Key changes from the Original Proposals

The Revised Proposals contain a number of key changes from the Original Proposals.

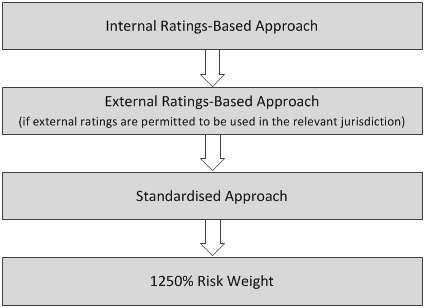

Firstly, they set out a simplified hierarchy of approaches, starting with the Internal Ratings-Based Approach (the “Internal RBA”), followed by the External Ratings Based Approach (the “External RBA”), the Standardised Approach (the “Standardised Approach”) and finally the application of a 1250% risk weight. The approaches themselves have been revised and in some respects have been simplified.

Secondly, the calibration of the approaches has been adjusted, which would result in significant reductions in risk weights compared with the Original Proposals (although risk weights remain higher than under the current framework).

The Revised Proposals also include a number of changes and clarifications to what was set out in the Original Proposals. These include the basis on which maturity, a required input in the Internal RBA and the External RBA, would be determined. Despite requests from market participants for maturity to be determined on the basis of weighted average life in order to reflect more accurately the actual risk of a tranche, the Basel Committee has rejected this suggestion, due to concerns about relying on banks’ internal models and assumptions. Consequently, maturity would still be determined by reference to the contractual cashflows of the tranche (where such payments are unconditional and not dependent on the actual performance of the securitised assets) or final legal maturity.

The Revised Proposals also include the following changes from the Original Proposals:

- a 15% risk weight floor which would apply for all approaches, reduced from the 20% risk weight floor in the Original Proposals;

- an overall cap on capital requirements for banks acting as originators or sponsors and using the External RBA or the Standardised Approach, whereby such banks could apply a maximum capital requirement for their securitisation exposures equal to the capital requirement that would have been assessed against the underlying exposures had they not been securitised;8

- a risk weight cap for senior securitisation exposures, using a “look-through” approach, under which the senior securitisation exposure could receive a maximum risk weight equal to the average risk weight of the underlying exposures, provided that the bank had sufficient information as to the underlying exposures at all times; and

- clarification of the definition of a resecuritisation exposure.9

As a general principle, the revised standards text indicates that, in order to use the securitisation framework, banks would be required to have a comprehensive understanding of the risk characteristics of their individual securitisation exposures as well as the risk characteristics of the pools underlying those exposures. Banks would also be required to be able to access performance information on the underlying pools on an ongoing basis and in a timely manner10 and to have a thorough understanding of all structural features of a securitisation that would materially impact their exposures.11 If the bank were unable to perform the required level of due diligence it would be required to apply a 1,250% risk weight to the relevant exposure.

In the remainder of this Clients & Friends Memo we focus on the revised hierarchy and the proposed approaches.

Hierarchy of approaches

Below is a diagram of the proposed hierarchy of approaches under the Revised Proposals:

At the top of the hierarchy is the Internal RBA. This is based on the IRB approach capital charge for the underlying pool of exposures.

If it were not possible to use the Internal RBA (for example, if the bank did not have sufficient information on the underlying assets), it would then be necessary to move down the hierarchy to the next available approach.

The next approach is the External RBA, which could be used in jurisdictions where the use of external ratings is permitted and where tranches have an external credit rating or where a credit rating can be inferred. In the case of unrated exposures to asset-backed commercial paper programmes, the Internal Assessment Approach (the “IAA”) could be used if certain conditions were met.

If the above approaches could not be used, the Standardised Approach would be applicable. The calculation of the applicable risk weight would be based on the underlying capital charges using the current standardised approach.

In the event that none of the above approaches were available, a 1250% risk weight would be applicable.

Below is a summary of each of the revised approaches.

Internal RBA

The Internal RBA would apply to banks that have supervisory approval to use an IRB approach, where they have a suitable IRB model and sufficient information to estimate the IRB capital charge for the underlying pool if it had not been securitised (known as KIRB12). The Internal RBA formula also takes account of the credit enhancement level and the thickness of the relevant tranche. The Internal RBA is a simpler and more flexible approach than the Modified Supervisory Formula Approach (“MSFA”) included in the Original Proposals and is based on the previously proposed Simplified Supervisory Formula Approach (“SSFA”). Revisions include the recognition of excess spread.

The Internal RBA formula is based on the following inputs:

(i) KIRB;

(ii) the tranche attachment point (representing the threshold at which credit losses would first be allocated to the securitisation exposure);

(iii) the tranche detachment point (representing the threshold at which credit losses of principal allocated to the securitisation exposure would result in a total loss of principal); and

(iv) a supervisory parameter, “p”.13

Under the Original Proposals, the MSFA could not be used if the bank were unable to calculate the IRB parameters for all of the underlying exposures. Industry participants had commented that the MSFA would be limited in its availability for investor banks. While it remains the case under the Internal RBA that a bank will need to have approval to use the IRB approach and a suitable IRB model, the Revised Proposals introduce a degree of flexibility, allowing the Internal RBA to be used in the case of mixed pools, where the bank is able to calculate the IRB parameters for some but not all of the underlying assets. In such circumstances, the bank would be required to assign a 1,250% risk weight to exposures for which it cannot calculate the IRB parameters.

External RBA

The External RBA is based on the credit rating (from an external rating agency or where a rating can be inferred) of the exposure. The External RBA represents a simplified form of the RRBA included in the Original Proposals and, importantly, the calibration has been adjusted. In addition, it is no longer necessary for there to be two ratings.14 The External RBA is based on look-up tables containing risk weights for short-term and long-term ratings respectively, which would replace those in the current standardised and IRB approaches.

For short-term ratings, the risk weight for an A-1/P-1 rated exposure would be 15%, reduced from 20% in the Original Proposals.

For long term ratings, the risk weights would depend on the following factors:

(i) external or inferred rating;

(ii) seniority of the tranche;

(iii) maturity of the tranche; and

(iv) for non-senior tranches, tranche thickness.

The risk weight for a AAA-rated senior tranche with a maturity of 5 years or more would be 25%, down from 58% under the RRBA in the Original Proposals, but considerably higher than the 7% which currently applies for banks using the IRB approach.

The long-term ratings risk weights table sets out the percentages for maturities of 1 year and 5 years. As in the Original Proposals, maturity has a 1 year floor and a 5 year cap. For maturities between 1 and 5 years, the figures in the table would need to be adjusted using linear interpolation. Maturity would be calculated based on the Euro weighted average maturity of the contractual cashflows of the tranche (assuming no prepayments or defaults), provided that such payments are unconditional and not dependent on the actual performance of the securitised assets, or alternatively, final legal maturity. This could mean that in many cases the higher risk weights for the maximum 5 year maturity would apply.

Non-senior tranches would be subject to higher risk weights than senior tranches. While the risk weights for non-senior tranches could be adjusted downwards depending on the thickness of the tranche, the extent of such adjustment would be limited. In addition, the Revised Proposals indicate that such risk weights should never be lower than the risk weight corresponding to a senior tranche with the same rating and maturity, which could restrict the downwards adjustment of the risk weight for a thicker non-senior tranche.

While the revised calibration of the External RBA compared with the RRBA is likely to be seen as a positive development by many market participants, the maturity adjustments and the treatment of non-senior tranches remain a cause for concern. Industry participants had argued that the RRBA did not need to take account of maturity and thickness, since it was likely that these elements would already be taken into account in the ratings process. However, the Basel Committee has concluded that these factors are not fully reflected in ratings. In contrast, granularity would no longer be included in the External RBA calculation on the basis that it would be taken into account by rating agencies.15 A further nuance is that where a bank provides a commitment in respect of a securitisation, the bank must calculate maturity as the sum of the contractual maturity of the commitment and the longest maturity of the assets to which the bank could be exposed, and in the case of revolving transactions, the longest contractually possible remaining maturity of an asset that might be added during the revolving period would apply.

The increased risk weights which would apply under the External RBA could have an impact on the yields required by investors, and the adjustments to take account of the thickness of non-senior tranches could have an impact on the capital structure of securitisation transactions.

The External RBA is unlikely to be available in the United States since references to credit ratings in regulations are not permitted under Dodd-Frank.16 This may lead to some inconsistency compared with jurisdictions where the External RBA is permitted to be used, although the Basel Committee expects that the risk weights will be roughly comparable as between the External RBA and the Standardised Approach.

Internal Assessment Approach

As in the Original Proposals, the IAA would be retained for unrated exposures to asset-backed commercial paper programmes such as liquidity facilities and credit enhancement, provided that certain operational requirements are met in relation to the bank’s internal assessment process, including supervisory approval. Under the IAA, the bank would map its internal assessments to equivalent rating agency ratings and the appropriate risk weights would be determined under the External RBA.

Standardised Approach

The Standardised Approach is a revised version of the SSFA in the Original Proposals. Under the Standardised Approach, capital requirements would be calculated using the following:

(i) the weighted average capital charge under the standardised approach for the underlying exposures in the securitised pool (known as KSA);

(ii) a factor “W”, being the ratio of the sum of the amount of all delinquent exposures in the underlying pool to the total underlying exposures;

(iii) the tranche attachment point; and

(iv) the tranche detachment point.

For resecuritisation exposures a supervisory parameter, “p”, set at 1.5, would also apply (“p” would be set at 1 for other securitisation exposures under the Standardised Approach).17 The Standardised Approach would be the only approach available for resecuritisation exposures (apart from applying a 1250% risk weight).

The resulting capital requirements under the Standardised Approach are intended to be broadly aligned with those obtained under the External RBA and slightly higher than those obtained under the Internal RBA.

Next steps

Comments may be provided to the Basel Committee before 21 March 2014. The Basel Committee is also encouraging market participants to take part in a second quantitative impact study (“QIS”), including the collection of loan-level data. Following review of the comments and the results of the QIS, the Basel Committee intends to publish the final standards and to provide sufficient time for implementation. Importantly, it is not intended that grandfathering provisions will be included. The exact timing for the publication of the final standards remains uncertain, although it is expected that this will occur by the end of this year, and detailed implementation arrangements remain subject to further discussion by the Basel Committee.

Conclusion

Market participants are likely to consider the simplified hierarchy and the amendments made to the proposed approaches to be generally positive developments, compared with the Original Proposals. The Basel Committee has clearly taken a number of the responses of market participants into account, and banks are likely to welcome the revised calibration and the reduction in risk weights compared with the Original Proposals. However, there will still be significant increases in risk weights under the Revised Proposals compared with the current framework, and industry participants may still consider these to be too high, particularly with respect to certain high quality assets and in comparison with the treatment of other financing products. There are still concerns that increased capital requirements will discourage participation in securitisation transactions, an outcome that appears to be inconsistent with recent comments from the European Commission, the European Central Bank and the Bank of England expressing support for the revival of the securitisation industry as a funding source.18

1 Consultative Document – “Revisions to the securitisation framework”, which was published on 19 December 2013 and can be found at http://www.bis.org/publ/bcbs269.pdf.

2 The framework set out in the document entitled “International Convergence of Capital Measurement and Capital Standards – A Revised Framework, Comprehensive Version” published in June 2006, which can be found at http://www.bis.org/publ/bcbs128.pdf, as amended.

3 This is based on the IRB capital charge had the underlying exposures not been securitised, the tranche’s credit enhancement and thickness, the number of exposures in the pool and exposure-weighted loss given default.

4 Cliff effects were observed during the financial crisis where small changes in the quality of the underlying pool of securitised exposures quickly led to significant increases in capital requirements.

5 Consultative Document – “Revisions to the Basel Securitisation Framework”, which was published on 18 December 2012 and which can be found at http://www.bis.org/publ/bcbs236.pdf.

6 Under the Original Proposals, the two hierarchies were as follows:

Alternative A

(i) Modified Supervisory Formula Approach

(ii) Revised Ratings-Based Approach (or Internal Assessment Approach) or Simplified Supervisory Formula Approach (depending on the choice made by the relevant jurisdiction)

(iii) Backstop Concentration Ratio Approach

(iv) 1250% Risk Weight

Alternative B

(i) For senior high quality tranches, Revised Ratings-Based Approach (or Internal Assessment Approach) or Modified Supervisory Formula Approach, or Simplified Supervisory Formula Approach if permitted by the supervisory authority, and for all other tranches a Concentration Ratio approach

(ii) Backstop Concentration Ratio Approach

(iii) 1250% Risk Weight.

7 Market participants argued that a bank should not be required to hold substantially more capital than if it held the underlying exposures directly.

8 A similar cap would be applicable to banks using the IRB approach (whether acting as originators, sponsors or investors), as under the current framework.

9 A resecuritisation exposure is defined in the new standards text as “a securitisation exposure in which the risk associated with an underlying pool of exposures is tranched and at least one of the underlying exposures is a securitisation position”. Exposures resulting from retranching will not fall within the definition of a resecuritisation if they act like a direct tranching of a pool with no securitised assets. It appears that CLOs with small percentages of securitisation exposures (e.g. 5% securitisation buckets) would fall within this definition (despite requests to exclude them) and would therefore be subject to higher capital requirements.

10 Such information may include exposure type, percentage of loans 30, 60 and 90 days past due, default rates, prepayment rates, foreclosures, property type and occupancy, credit scores or other creditworthiness measures, average loan-to-value ratio and industry and geographic diversification. In the case of resecuritisations, information is required in relation to both the tranches of the underlying securitisation and the pools underlying that securitisation.

11 These could include the waterfalls and waterfall-related triggers, credit enhancement, liquidity enhancement, market value triggers and definitions of default.

12 KIRB is the ratio of (a) the IRB capital requirement, including the expected loss portion, for the underlying exposures in the pool to (b) the exposure amount of the pool (e.g. the sum of drawn amounts related to securitised exposures plus the exposure at default associated with undrawn commitments related to securitised exposures). The positive value of any interest rate or currency swaps would be included in (a).

13 In the Internal RBA, “p” would be based on maturity, loss given default, KIRB and number of loans and would differ for senior and non-senior tranches and for wholesale (granular and non-granular) and retail transactions. The Basel Committee has requested suggestions on how to simplify this parameter.

14 However, two ratings may still be required under CRA3 (Regulation (EU) No. 462/2013 of 21 May 2013, amending Regulation (EC) No. 1060/2009 of 16 September 2009 on credit rating agencies). See the Cadwalader Clients & Friends Memo entitled “CRA3 – New Requirements Affect Issuers, Originators and Sponsors as well as Rating Agencies” for more information.

16 Section 939A of the Dodd-Frank Wall Street Reform and Consumer Protection Act requires the removal of any reference to credit ratings in regulations.

17 In the SSFA, “p” was set at 1.5 for all exposures. We note that “p” is set at 0.5 in the SSFA under the US rules implementing Basel III, except in the case of resecuritisation exposures where it is also set at 1.5.

18 For example, in the Green Paper entitled “Long-Term Financing of the European Economy” published by the European Commission on 25 March 2013, in the keynote speech by Yves Mersch of the European Central Bank on 13 November 2013 entitled “Investment and Investment Finance: Putting Europe on a sustainable growth path” and as reported in the Financial Times article “BoE champions bundled debt” on 10 December 2013.